In the midst of a broad societal change fueled by millennials’ focus on usage over ownership, fashion brands are looking for ways to a new, promising growth alternative. They may have found in the sharing economy. Whether it consists in purchasing used clothes or borrowing them, the “Pre-owned” model helps prolong the longevity of clothing. Resale platform ThredUp, predicts that the global market for secondhand clothing will reach $51 Billions by 2023.

Through clothing subscription services, online platforms like Rent The Runway, which boasts 6 million members, or Le Tote, are leading this secondhand market overhaul, set to overtake fast fashion sales by 2028.

In order to delay the possibility of a “Retail apocalypse”, department stores, but also fashion retailers and resale platforms, have signaled a growing interest in the “Pre-owned” fashion market.

When the sharing economy comes to the rescue of planet Earth and style differentiation

Craving transparency and fair pricing, millennials prefer to pay usage costs rather than bear ownership constraints.

The average number of times a garment is worn has decreased by 36% in the last 15 years. Consequently, clients are increasingly drawn to consignment stores where they can purchase vintage outfits at a fraction of their original price.

Due to global warming concerns, clients have made it possible to develop an alternative way of consumption embodied by the sharing economy. Le Tote commercial claim, “Wear – Return – Repeat” effectively demonstrates the platform’s desire to curb consumerism. Secondhand fashion marketplace, ThredUp, noticed an 80% spike in clean out kits when sustainability figure Marie Kondo’s show first aired on Netflix.

The platform, quickly followed by other such as Armarium, has given Millenials and their younger counterparts the opportunity to reinvent the great game of red-carpet dressing and fully endorse their celebrity fantasies.

Today, rental systems are particularly thriving in the US, while they are still nascent in Europe, with the exception of Germany. However this sharing economy is not accessible to every brand: growth is slow and requires expensive stock acquisition. Rent The Runway only broke even in 2017, after a $200 million fundraising.

The fashion rental system, which worked initially on an item-by-item basis for occasional rentals, has transformed into total wardrobe replacement.

Are consumers truly advocating for a more sustainable fashion?

Clothing subscription: absolute luxury and retail’s new promising feature

Brands, mostly luxury ones, used to be reluctant to the idea of seeing their garments on pre-owned platforms due to the threat of brand banalization and full-priced item cannibalization.

After gaining the trust of high-profile luxury fashion brands, Rent The Runway, launched its “Unlimited” subscription scheme in 2016. This act radically changed the industry’s misconception of vintage clothing and shaped clothing subscription services in the digital era. It allows users to borrow 4 pieces at a time for a monthly subscription fee of $139.

Rent The Runway claims 10,000 Unlimited subscribers, mostly looking to update their office wear.

Clothing subscription helps fighting with “wardrobing”, a form of return fraud which happens when the client returns his purchase for no reason other than to change styles without paying the price.

This CaaS (Clothing as a Service) relies on a highly reliable supply chain which delivers high-profile clothing curation, prepaid labels and green dry cleaning.

For designers, especially lesser known ones, the system offers unprecedented visibility and direct client-wearing feedbacks. Experts agree that the business model is better suited for statement outfits than basics. As so, the system enables designers to further express their boldness through polarizing designs and allows the client to experiment with more extravagant styles.

Now several brick and mortar distribution veterans are jumping into the fashion rental market. In the department store universe, Neiman Marcus took a minority stake in secondhand apparel, Fashionphile, while Galeries Lafayette started a partnership with French startup, Panoply.

In the retail field, footwear brand Bocage, recently provided a clothing subscription “atelier” where the client can have access to 300 pairs of shoes for a €29 monthly fee.

Urban Outfitters’ parent company could be the boldest foray with the launch of its own subscription service entitled Nuuly in the US. The group expects to gain 50 000 subscribers and reach $50 million in sales in its first year through its women’s wear offer encompassing brands like Anthropologie, Levi’s and Fila.

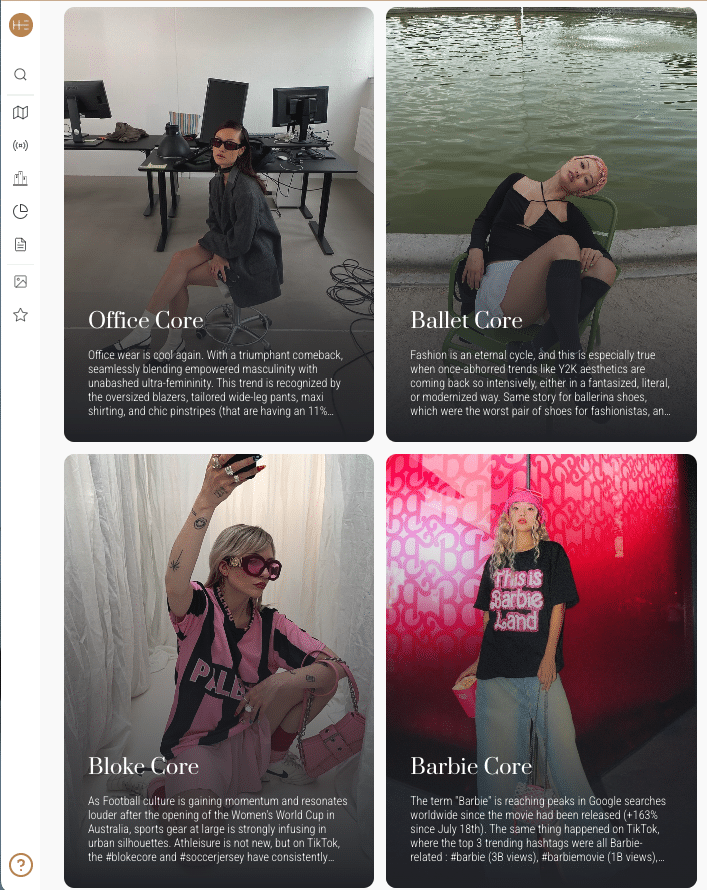

For brands and retailers to gain a deeper understanding of client expectations and deliver a relevant offering in such a moveable world, Heuritech delivers a cutting-edge tool through the use of artificial intelligence.