Acquiring a luxury product has always been a matter of authenticity, emotion and exclusivity between clients and brands. But in the Internet era, distribution channels have multiplied, products, like sneakers and sporty limited edition drops, are more accessible, and so are prices.

As devastating in the long run as counterfeit, the grey market is less known and mistakenly more tolerated.

Also known as “parallel import”, the grey market encompasses suppliers or distributors selling genuine, branded items which are legally distributed outside official distribution channels without the trademark holder’s permission, often making profit through an aggressive markdown strategy.

By 2022, the resale market will be worth $41 billion, up from $20 billion in 2017, according to a 2017 Thredup Report.

As the grey market increasingly goes online, the large amount of daily transactions and the multiplication of marketplaces make it harder to clearly identify clients.

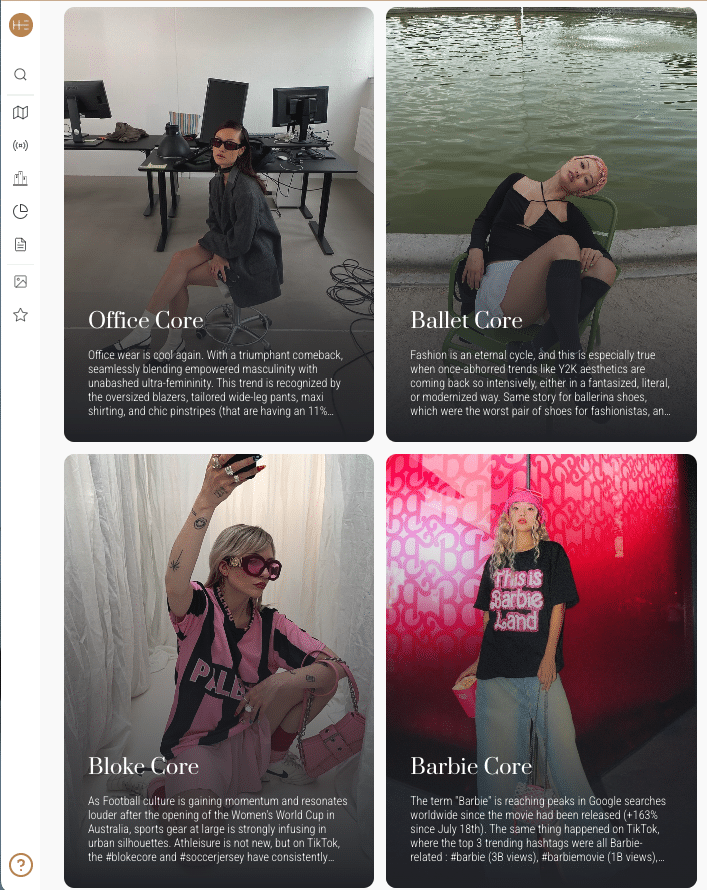

According to a Heuritech study, 15% of Instagram posts are commercial, i.e. with a sales purpose, with this figure growing as products become more desirable.

Our visual and textual recognition technology is able to identify posts with a commercial purpose thanks to a series of criteria such as phone number identification or price.

A strategy based on exclusivity is not the only choice for luxury brands

While ownership has now been replaced by product function, luxury products benefit from investment value with a secondary market price tax rating.

For instance, some brand-name, addicted sneakerheads now sell limited edition shoes on the resale market for profit. Social media is imposing a new rhythm, that of constantly offering novelty. The pre-owned market thus represents a very bright future for luxury players.

According to Claudia D’Arpizio, a Partner at Bain, “second-hand luxury is the response to a growing consumer demand for more reasonably priced products without giving up name brands.”

Clients, particularly millennials, praise a new form of luxury where exclusivity is replaced by inclusivity, as can be seen with millennials’ favorite Italian brand, Gucci, and as Balmain recently affirmed on Instagram with its new campaign.

Is distancing oneself from the client still effective for luxury brands? Or should luxury brands embrace second-hand ?

Second-hand luxury can be seen as a new growth driver and another high-quality, entry-level offer, such as perfumes, bags and shoes.

Resale enthusiasts are convinced that this system allows one to save money and unearth unique pieces to compose singular looks.

Pioneers, such as Rent the Runway, have created a new market, a leasing service with option to buy which allows the client to experiment the product in real-time. The Kering group also tested its own rental subscription service this year.

The resale market is booming: according to Julie Wainwright, Founder of The RealReal, sales on the platform reached $500 million in 2017 after making just $10 million its first year in 2011.

In its State of Luxury Resale Midyear 2018 report, the RealReal revealed that Gucci is the most sought-after brand on the consignment platform, ahead of Louis Vuitton, Chanel, Louboutin and Hermès.

LVMH recently partnered with Stadium Goods, while Cartier’s parent company, Richemont, acquired second-hand watch-selling platform, Watchfinder.

On the grey market, there is of course a huge difference between a private seller, using marketplaces to acquire new items or replace unworn pieces from his wardrobe, and a professional one owning a well-off boutique.

How a permissive grey market could be harmful to the luxury business

The 2017 Deloitte Swiss Watch Industry study revealed the alarming amount of ground lost by luxury brands over control of their distribution network. In fact, while 83% of watch executives in 2014 thought that shop-based, authorized dealers were their most important sales channel, they were only 24% to think so in 2017. Products targeted by grey market resellers not only include watches, but also eyewear and handbags.

Up until now, these grey market resellers have been acting clandestinely, looking to benefit from the 12% VAT tax refund given to Parisian tourists. Because they were often buying at least two identical items (same size, same color), numerous brands implemented quotas to avoid the rapid development of this movement.

Due to waste reduction concerns and commercial objectives, brands can easily succumb to the grey market as a sales channel for surplus stock, to the extent of not being cautious as to the vendor profiles.

The major drawback of the grey market is the dilution of the product’s value due to an off-price strategy and the product being featured in a mass distribution, on the “rack” setting.

Grey market watches are very often sold 25% to 35% cheaper than through authorized reseller networks.

The other downside concerns the final clients as soon their products need servicing. Authorized resellers provide clients with peace of mind with an official manufacturer warranty, expertise information, production provenance and techniques.

The grey market feeds on scarcity or unavailability of a product through authorized channels. Some products are simply unavailable in some countries, or highly taxed, making unauthorized transactions attractive.

In fact, the key factor of this thriving grey market activity is import taxes. Luxury product pricing used to be 51% higher in China than in the US and 72% higher than in France.

To face the endemic scourge, numerous luxury brands have harmonized their prices to curb the trend, like Chanel’s initiative in 2015 to fill the pricing gap between local markets and foreign markets. To do so, the brand increased its prices by 20% in Europe, while dropping them by 20% in Asia.

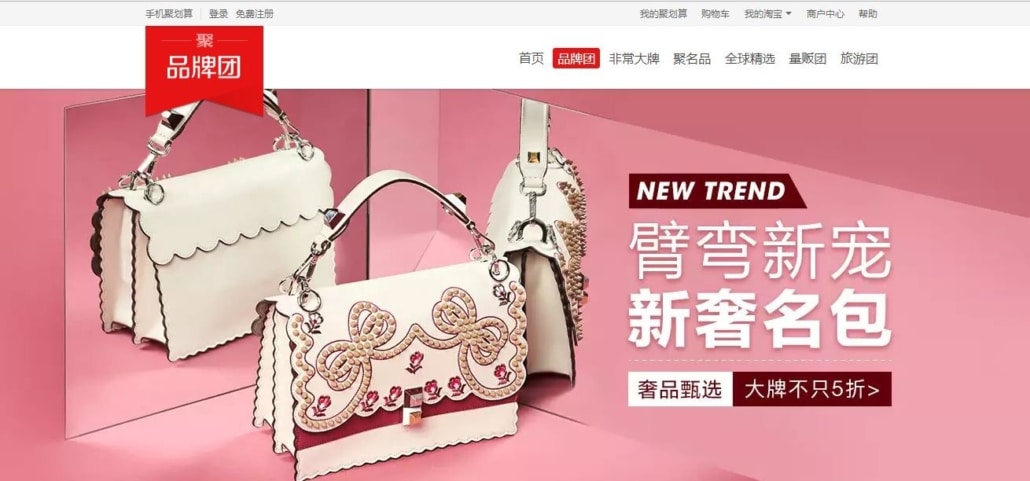

Among unwanted merchants and luxury business antagonists are “daigous”: Chinese, but also South Korean overseas personal shoppers, purchasing unavailable or highly taxed, luxury items abroad on behalf of resident clients. Many of them are proliferating on Instagram.

According to a 2015 Bain study, the grey market resulting from daigou sales is worth RMB 55 billion and RMB 75 billion (€8 billion to €11 billion) which represents 15% of overall luxury purchases by Chinese clients on every network.

Artificial Intelligence: the wondrous, new filter against unauthorized dealer channels

The grey market is a situation which is tolerated by luxury players and lacking in authentication feedback.

In an attempt to restore their exclusivity, desirability and trust, luxury brands have chosen to limit the availability of their products or affix RFID microchips in them, such as Salvatore Ferragamo started doing in 2014 or Moncler in 2017.

But contrary to branded leather goods, which can be identified with a serial number, it is more difficult to track apparel. As so, brands are often submerged to clearly identify their lifespan products actors.

Artificial intelligence can help brands to identify unauthorized resellers on mass-market e-commerce platforms such as Ebay, Amazon or Chinese marketplaces Taobao and Tmall.

For example, the Cypheme mobile app applies real-time tracking from the product packaging scan in order to certify the product’s authenticity and effectively fight against counterfeiting.

Image recognition technology can help brands spot unwanted vendors and accounts spamming with their products by identifying irrelevant pictures online.

As one of Heuritech’s studies recently found, 70% of a brand’s product posts do not have a brand mention — neither hashtag, nor tag — on Instagram.

Mastering the distribution of its products is definitely on each luxury brand’s checklist. Visual recognition technology can truly be an eye opener to better monitor products online, and in fine to reinforce inventory management for each brand, from warehouse to retailers. Better knowing the desirability of a product helps to forecast sales and stock, particularly for product launches.